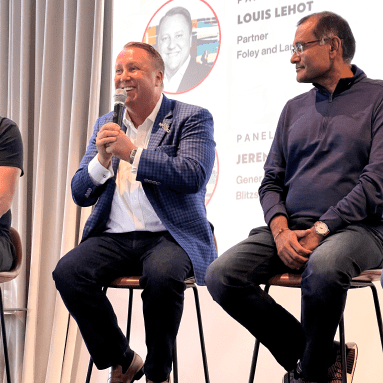

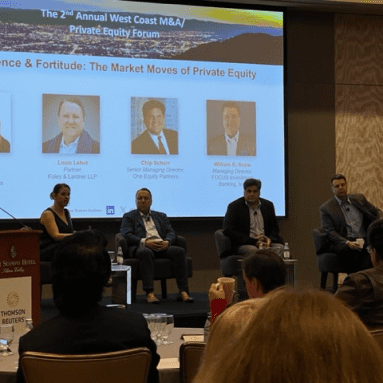

LOUIS LEHOT

Partner at Foley & Lardner LLP

Helping businesses and ventures with compelling technologies reach their growth objectives with sound legal strategies and solutions.

ABOUT

Louis Lehot is a partner and business lawyer with Foley & Lardner LLP, based in the firm’s Silicon Valley, San Francisco and Los Angeles offices, where he is a member of the M&A and Transactions Practices, Private Equity & Venture Capital, and the Technology, Health Care, and Energy Industry Teams.

Louis Lehot’s corporate, securities and M&A law practice focuses on advising public and emerging private companies and their venture capital and private equity investors from formation to liquidity. He regularly acts as company-side counsel in mergers, acquisitions, dispositions, spin-offs, strategic investments and joint ventures.

Public and private companies, financial sponsors, venture capitalists, investors and investment banks seek him out for smart counsel and skill in forming, financing, governing, buying and selling companies.

His domain experience in public offerings and private placements of equity, equity-linked and debt securities, mergers, acquisitions, dispositions, spinoffs, strategic investments and joint ventures, as well as corporate governance and securities law compliance matters, serves his clients well. He regularly represents US and non-US registrants before the SEC, FINRA, NYSE and NASDAQ.

Prior to joining Foley, Louis was the founder of L2 Counsel, a Silicon Valley boutique law firm.

Louis Lehot Profiled as One of the Ten Most Inspiring Leaders to Follow in 2023

Foley & Lardner LLP Partner Louis Lehot is profiled in The Inc Magazine article, “Louis Lehot, Taking Companies from Garage to Global,” as part of the publication’s The Ten Most Inspiring Leaders to Follow in 2023 series.

LOUIS LEHOT ON INSTAGRAM

Foley Significantly Expands Capabilities In The Fast Growing Technology And Life Sciences Sectors.

TESTIMONIALS

AWARDS & RECOGNITIONS

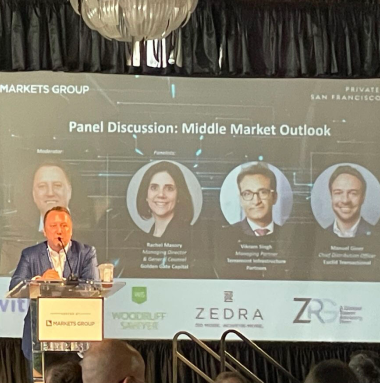

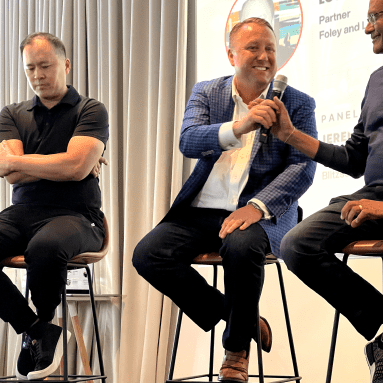

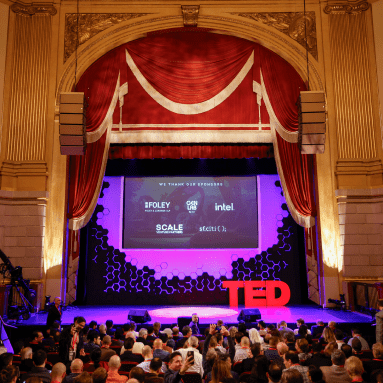

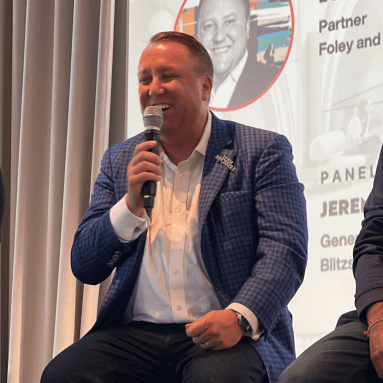

SPEAKING ENGAGEMENTS

GIVING BACK

ARTICLES PUBLISHED BY LOUIS LEHOT

FREQUENTLY ASKED QUESTIONS

- Q1. What industries does Louis Lehot specialize in?

Louis Lehot is a leading corporate lawyer specializing in mergers and acquisitions, private equity and venture capital investments, and helping innovative companies go “garage to global.” He works with organizations in an array of industries including technology, healthcare, life sciences, and clean energy.

Louis provides practical, commercial and strategic legal counsel to private and public companies involved in growth and liquidity events. He works on deals involving venture funding, mergers, acquisitions, spinoffs, strategic investments, and joint ventures. In addition, companies and investors seek Louis out for counsel in forming companies, financing, governing, and buying and selling businesses.

Importantly, Louis has always taken a keen interest in supporting companies as they cross borders and enter new markets abroad, helping them navigate the legal and cultural landscape successful overseas expansion must cross.

Louis regularly represents companies in numerous industries—public or going public, US and non-US registrants—in dealing with the U.S. Securities and Exchange Commission, the Financial Industry Regulatory Authority, the New York Stock Exchange, and the NASDAQ stock exchange.

- Q2. What is the significance of mergers and acquisitions in the current business landscape?

Mergers and acquisitions represent one of the most common and often the most beneficial exit strategies for startups. M&A plays a leading role in integrating innovation into markets over the longer-term.

Tech entrepreneurs and startups are driven by much more than profit. These innovators are passionate about their inventions and want to see the products they develop in action, changing people’s lives and becoming mainstream in the long term—from new medicines to AI applications and apps that help manage your diet.

By finding the right M&A partner and negotiating the right deal, startups can both cement a strong future for their innovation and achieve the best financial results for the innovators and their investors.

When startups reach maturity, they have to take the next step. For the majority, an IPO is either not possible or is not the best option. For instance, the inventor of a fingerprint biometric scanner for smartphones has a product better suited for an M&A, since the technology is only a small part of a bigger device.

However, finding the most suitable M&A partner and structuring a deal that meets the startup’s and founders’ hopes and goals can be difficult. Wrong decisions and wrong deals can destroy years of hard work. And that’s only step 1. Step 2 is the legal expertise and efforts needed to outline the deal and oversee the due diligence involved on both sides.

- Q3. What services does Louis Lehot offer for M&A transactions?

The term M&A is a broad one that means different things to different companies in different deals. An M&A transaction may refer to one company purchasing or absorbing another, a merger where two companies join together, an acquisition of major assets in a company, a tender offer to buy a company’s stock, or a hostile takeover. Companies large and small, public and private, need ongoing counsel to help them identify, structure and execute the deal that’s right for them, provide the legal framework that can optimally make it happen —and then make sure it happens successfully.

Louis Lehot represents buyers in creating acquisition programs, selling companies, purchasing assets, merging with other firms, and licensing. Louis’s clients range from bootstrapped startups to venture-backed emerging growth companies, to public companies, and the venture capital and private-equity financial sponsors that fund these entrepreneurs. His clients have included venture capital and private equity firms and corporate venturing groups that make investments in technology, healthcare, clean energy, and other innovative businesses.

Louis’s aim is to achieve liquidity events that are win-win for both sides, entrepreneurs and investors, and to create the right market fit for the innovative products involved.

- Q4. How can legal support enhance private equity and venture capital endeavors?

The process of investing and acquiring startups can be wildly lucrative, but at the same time wildly risky. Parties on both sides of a deal need to find the right partner, the right deal, and importantly, the right legal counsel to ensure the best options are sought and that everyone does their part to ensure success.

Legal counsel create the legal framework to make it all happen. This includes:

Structuring the deal. A well-structured deal maximizes returns while minimizing risks. At the same time, transactions must meet regulatory requirements and serve the interests of investors and partners on both sides.

Contracts. The legal governor of all investments is the documentation and contracts that outline the deal and spell out all that is expected. The legal counsel behind these investment deals drafts investor agreements, shareholder agreements, and employee contracts—all to apportion the risks and rewards, incentivize and align the parties for success, reduce the likelihood of disputes and have in place a plan of action for when disputes do arise.

Due diligence. A strong legal team helps an investor test the price and conduct thorough due diligence (and a company defend price against a thorough due diligence investigation) to identify legal risks in a deal. Issues may involve commercial contracts, intellectual property rights, regulatory compliance, past or ongoing litigation, and other legal aspects.

Risk management. Legal teams identify and mitigate potential legal risks in investment, on everything from assessing potential legal liabilities to protecting investors’ interests.

Exit strategies. Both sides of an investment are there for the same reason: reaching the point where it all pays off. A well-structured and documented deal will outline exit strategies so that when the time comes, all parties are ready with a roadmap in hand.Dispute resolution. Disputes will happen: It’s human nature and it’s why the best legal counsel is sought for investments. Strong counsel will both anticipate possible disputes and seek a favorable resolution when they occur.

- Q5. What role do legal professionals play in the technology sector?

IP protection. When an inventor, entrepreneur, or startup develops a novel technology, the first step in bringing it to market is legal counsel, to protect intellectual property and to explore deals that may fund its development and initial marketing. Among the issues legal counsel will advise on or oversee are:

Intellectual property protection. Entrepreneurs and companies developing technology must constantly be working to protect it. Protection includes filing for patents, trademarks, and copyrights, as well as working to avoid infringement, enforce rights, and defend against infringement should rivals claim they got the idea first.

M&As. Mergers and acquisitions are goals of most startups, a time to cash in on years of hard work, pay off now-happy investors, and set innovations permanently onto the market. Legal counsel oversees deal structuring, contracts and documentation, due diligence, regulatory compliance, and other essential legal details.

Litigation and dispute resolution. Unfortunately, the tech world is as competitive as it is innovative, and too often that winds up involving litigation. It can come from any direction, from patent trolls (companies that file patents only so they can sue future inventors) to competitors to investors. This is why tech companies hire legal professionals who are experts at IP law, infringement and pirating, contract breaches, and other relevant areas of law.

- Q6. How do lawyers serve clients in the Health Care and Energy industries?

Lawyers serving clients in the Health Care and Energy industries help navigate and solve complex issues unique to these sectors.

In the Healthcare industry, attorneys may assist clients with regulatory compliance, healthcare contracts, licensing, and addressing issues related to patient care and privacy. Healthcare lawyers may also be involved in matters such as healthcare litigation, medical malpractice defense, and advising on the implications of healthcare policies and regulations.

In the Energy industry, legal professionals may help clients with regulatory compliance, environmental law, project development, and negotiations with stakeholders. They specialize in areas such as renewable energy, oil and gas, and utilities, offering legal support on project financing, permits, and compliance with environmental regulations and industry standards.

- Q7. What role do legal professionals play in providing services for emerging private companies

Legal professionals support emerging private companies by providing legal services tailored to a company’s specific needs. This may include assisting with entity formation, advising on risk management, drafting and negotiating contracts, intellectual property protection, employment matters, and regulatory compliance, among others. Lawyers also help such companies through legal issues related to financing, mergers and acquisitions, and corporate governance.

Additionally, they may assist in litigation and resolving disputes, offering legal representation when necessary. Overall, legal support is essential for emerging private companies to establish a strong foundation and thrive in their respective industries.

- Q8. What are the stages of venture capital funding?

There are four different stages where we see venture capital firms focusing, each with its own specific characteristics.

- Seed Stage

After you have raised money from friends, family and business angels, and you have developed a minimum viable product or “MVP,” and are at a point where you are able to demonstrate product-market fit and are probably collecting revenue, you can consider approaching seed-stage venture capital investors. - Early Stage

Early stage funds now are focusing on “Series A” and “Series B” stage companies. While historically Series A was seed stage, it is now a “tweener,” having demonstrated product-market fit by trailblazing disruption to a category, and showing four quarters of double digit revenue growth. In today’s world, Series A and Series B funding rounds are scaling capital, with money being deployed to boost sales and marketing and further develop product. - Growth Stage

Series C, D, E and further rounds are what we call “growth stage.” While historically this capital was for scaling, it is now used for product development, M&A, going global and fueling hyper-growth. A startup that has made it to this stage is quite successful and looks for additional funds to help develop new products, expand to new markets or even acquire other companies in order to grow its own business. - Pre-IPO Stage

By this time, a startup is looking for money for the sole purpose of going public.

- Seed Stage

- Q9. What should we consider before raising a first round of venture capital?

- First make sure you have an experienced advisory team. This is significant because your advisory team will provide valuable input that will save your company time and money. One way to resource an advisory team is by asking your network for references.

- Clean up and prepare all your marketing and investment documents. The executive summary, the investor pitch deck slides, and your financial model are the main three documents necessary when approaching VCs.

- Create a targeted list of investors with preferences that you fit into, this includes things such as industry, size of investment, geography, among others.

- Before approaching more investors, update your pitch with the feedback you have received from previous interactions with investors that decided not to invest in your project.

- Continually practice and revise your pitch with your advisory team, to make it more refined.

- Review your legal documents with your attorney to make sure they are ready for the new investment.

- Make sure to be polite and in a good mood. Watch your online reputation. Be communicative and follow-up. Make sure to avoid any even small detail that could turn off the investor.

- Q10. As a startup, who should we approach for seed stage funding?

As you embark on your first fundraise or a full venture capital round, startup founders need to know who they are talking to when they go out to raise money. You don’t want to waste your time or be “out of school” approaching late stage funds when you are pre-revenue. With many funds focusing on a vertical strategy, founders must also pursue funds in their space.

- Q11. What are the key financing instruments used in the various stages of venture capital?

- Convertible Note

A form of short-term debt that converts into equity, typically in conjunction with a future financing round. - SAFE

The ubiquitous form of financing for pre-seed and seed stage companies, this refers to the “Simple Agreement for Future Equity” created by the Y Combinator accelerator to simplify the process of fundraising for companies and conserve resources - Equity Round Term Sheets

NVCA has recently issued a suite of new model legal documents to be used in venture capital financings, including a new model venture capital term sheet, with explanatory footnotes and links to background material. - Ratchets

A term whereby an investor’s prior investment is adjusted (usually upward) upon the occurrence of a specified event. A typical “ratchet” scenario occurs to enable an earlier investor to be issued additional shares upon a later investor purchasing shares at a lower price. A ratchet is often the mechanism used to ensure anti-dilution protection, but can also be used to adjust value for other events. - Carve-outs

This refers to a plan that is exempt from the liquidation preferences specified for the preferred stock holders in the charter, and “carves-out” an amount of proceeds from a sale transaction, usually to the management team, because the common stock is under water, or capital will not flow down to the management team that holds common stock in the “waterfall” of proceeds upon a sale

- Convertible Note

- Q12. Which corporate and securities filings does a startup need to file?

Corporate filings are required upon incorporation of your company and following several key events that will occur through your company’s lifecycle.

When your startup is first formed, you must file a charter. Regardless of where the charter has been filed, it will set forth the classes of stock held by the corporation, the rights and privileges associated with those classes, and the corporation’s purpose and agent’s address. Additional corporate filings can include:

- Changes to corporation name, purpose, or other matters: An amendment to the charter must be filed if the corporate name is changed, the corporation’s purpose is revised, or if the registered agent is different.

- Tax statements and reports:The corporation must file an annual tax statement or report, this often needs to be filed before a corporation can pay its annual taxes.

- Operating in other states:If your corporation operates or does business in states aside from where it is incorporated, you must file to do business in each of the additional states.

- DBA filings:If your corporation operates or does business under a name that is different from the corporate name, you must file a “doing business as” filing with the relevant state(s).

Corporations are also required to make sure any securities they issue comply with the state and federal laws. This could be done through filling with the SEC or finding an exemption. State securities laws will be different for each jurisdiction, so it is best to have your legal team review what is required for your corporation.

- Q13. Does a startup need a lawyer?

In the early stages of a startup company, taking legal support is one of the most important steps. Before panicking and hiring someone out of nowhere ask yourself what kind of legal support do you need? This will help you determine what your company needs and make sure that it is secured. Rocket Lawyer and Legal Zoom provide inexpensive forms if you need help with initial paperwork.

Some companies will need more legal support than others. Legally starting a corporation is simple, however hiring a lawyer or seeking legal counsel is crucial to make sure you do not miss anything. Lawyers can also aid with major legal challenges such as regulations, industry concerns, leasing agreements and more. It is also important to make sure all the legal documents are in order when the time comes for a round of venture investment or an exit. From our experience, it is usually more costly to fix these problems if a startup does not engage a lawyer to get everything right from early in the game.

Choosing the right Lawyer is also important when starting a corporation. Make sure you choose someone with an honorable reputation. It is also beneficial when that Lawyer is connected to a firm. Most likely, lawyers connected to firms have more resources and could help you with social networking.

- Q14. What should we do if a customer or client threatens a lawsuit?

Lawsuits are an unfortunate reality of many businesses. Sometimes an insignificant customer pain point can escalate into a class-action lawsuit very quickly. There are some tips to remember when your business is threatened with a legal action.

- First of all, don’t panic. Keep in mind that most threats don’t reach the stage of actual lawsuits because resolving a complaint via a court of law is a time consuming, high-effort and expensive process.

- Put yourself in the customer’s shoes to identify the best solution possible.

- Don’t take it personally.

- Pay attention to specific pain points in the customer’s story.When a customer gives you feedback, be sure to take lots of notes.

- Issue a sincere and authentic apology. The customer expects you to take responsibility when you make mistakes.

- Ask questions about their experience. By getting the customer to provide you with more information, you may uncover a workaround or solution that you didn’t see at first.

- Position yourself as a liaison between your company and the customer.

- Provide an effective solution. Just because the customer is threatening legal action doesn’t mean you can’t still meet their needs. In fact, providing an effective solution is probably the best way to de-escalate this type of issue.

- Seek Legal Advice from an Expert concurrently with taking the above actions.

- Q15. What are the stages of an M&A transaction?

As a company goes through an M&A transaction there are 8 key stages that typically occur:

- Preliminary informal conversation with potential buyers.

- Sign an NDA with potential buyers.

- Get a letter of intent (LOI) from potential buyers.

- Pre-signing period that includes negotiation of definitive terms, completion of due diligence and population of disclosure schedules.

- Signing of the terms.

- Pre-closing period to satisfy any additional pre-closing terms.

- Closing of the deal.

- Post-closing period during which the buyer takes care of full integration of your business.

- Q16. How can we run the most effective board meetings?

Once the first round of VC financing is closed, your startup will have to have more formal meetings with the board of directors. These meetings can provide beneficial relationships between the investors and the experts. Some ideas on what to take into account when planning your next board meeting:

- Plan and calendar board meetings for the next 12 months. You don’t want them to be too long or too frequent. However, there’s no on size fits all solution and your board meetings should be planned based on your company’s needs.

- Prepare and send a written presentation to for the board members couple of days in advance the meeting. Make sure it covers the critical operating and financial metrics of the company’s trajectory in the prior period.

- Avoid surprises, especially if they are negative. If you have experienced unanticipated headwinds in the development of the business during the period, those updates should be communicated in real-time, by regular phone update calls.

- A board meeting is different from a meeting of your executive staff or your employees. The meeting should give a high-level overview without getting too deep into the weeds.

- Your management team should have some access to the board to be able to demonstrate the quality of the team you are building.

- Practice both working and closed sessions. This way you’ll be able to productively discuss important questions for company development and gather feedback on the management team.

- Make sure your counsel is present to take notes and answer legal questions.

- Q17. What do we need to know about privacy and related considerations?

- Q18. What is PII?

Personally identifiable information (PII), which may also be called personal data or personal information, is a key concept when it comes to data privacy. PII refers to any information that can be used to identify a natural person or be reasonably associated with a natural person. This includes obvious identifiers such as names, emails, phone numbers, but can also include unique device identifiers, and information held in combination with other information where such combination can be used to identify a person. Most companies will encounter PII fairly early on, but the disclosures you will need to make will vary as your business grows.

- Q19. Which transaction structure is optimal for selling our business?

Evaluating the various structuring alternatives before undertaking a formal sale process allows the seller to choose a preferred structure and set expectations with prospective buyers regarding deal structure at the outset.

- Merger is one way for you to sell or get out of your company. In a merger, two companies that are distinct legal entities are consolidated into a single legal entity that holds the original companies’ combined assets and liabilities.

- In SPAC transactions, operating companies obtain an exit in the public markets by merging with a special purpose acquisition corporation (SPAC).

- In an acquisition one company is a buyer, while the acquired company often loses its name and is absorbed into the buyer. The seller’s operations are typically fully integrated into buyer’s operations and in such cases, separate branding disappears.

- In a stock sale, the buyer purchases each share of your company’s outstanding stock directly from each stockholder, with options treatment to be negotiated but typically involves being cancelled, accelerated and cashed-out or assumed by the buyer. Your company’s legal status will remain the same, and your company name, contracts, operations, etc., stay in place unless otherwise agreed upon by the acquisition agreement until the buyer integrates the seller’s business into its platform, which it typically may do so at its discretion post-Closing.

- In an asset sale, the seller does not dispose of the legal entity. Still, a buyer can obtain some or possibly all the company’s assets, and seller may continue to exist and potentially operate following the closing of the asset sale. Buyers typically cherry-pick the liabilities and obligations of the seller to assume, while the rest will remain with the seller.

There are multiple ways to sell your business when you are ready however these are the most common. Regardless, it is wise to seek legal counsel for more advice and planning before you make your decision.

SUBMIT A QUESTION

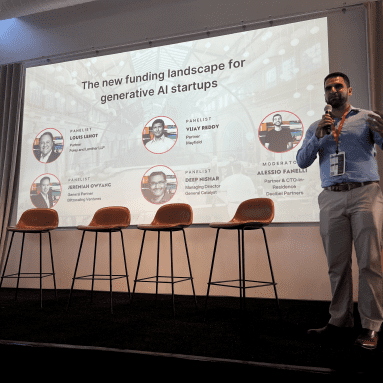

OUR GALLERY

CONTACT

For new business inquiries, please contact:

Attention: Louis Lehot

Direct voice: +1.650.796.7280

Email: llehot@foley.com

For media inquiries, please contact:

Direct voice: +1.925.284.5647

Email: lampert@elizabethlampertpr.com